Pricing Flatlined With 2022 – October Market Stats

October Market Highlights Median Sale Price is up approximately $4K Month-over-Month Cromford Index Drops to 121 (Weak Seller's Market) Year-over-Year Median Sale Price is down 0.3% Year-over-Year Avg Sale Price is up 6.1% My Two Cents Overall our market is following our typical seasonal patterns. The weather has FINALLY cooled off, bringing back many Continue Reading

Good News for Renters! – Market Update

We have good news for renters this month! The median rent has dropped over 7% in the last 90 days and rental supply (on the MLS) has increased 22% in the same timeframe. This means renters will find more options and slightly better pricing. Does this mean the market is on the verge of a crash? NO! Over the last couple of years we have seen the rise of a new rental concept; entire Continue Reading

Title Fraud is on The Rise

Recent months have shown an uptick in title fraud. Scammers have started preying on those with vacant land and no loans. They pose as the Seller, providing false identification documents to the real estate agent, title, and notaries. They list the land for sale with a reputable real estate broker, sell the property, take the proceeds, and disappear. Many counties are putting together Continue Reading

The Buyer Blip is Over – Market Update

We've all seen the news headlines, we've heard the Goldman Sachs prediction that the AZ real estate market is headed toward a 2008 level "crash". The stats just don't show that. ARE THEY LYING? A little back-story (bear with me for a moment and it will all make sense). One of my favorite college professors taught my statistics course. He would give the entire class the same set of Continue Reading

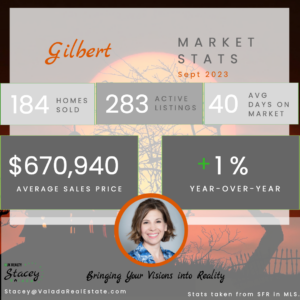

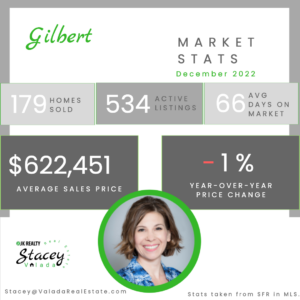

2022 Ended Where It Started

The start of the New Year tends to bring change and excitement. Our local real estate market is bucking that tradition this year. Instead, we are looking back. The price gains we saw in early 2022 have now evaporated and we are back to 2021 pricing. Not necessarily a bad thing given that many homeowners had been priced out of the market at this same time last year. Our sales volume is Continue Reading

Is it a Good Time to Buy a Home?

Buy now or wait! This is the question on all potential homebuyers’ minds this fall. Over the past few weeks, the mortgage interest rates have soared to a 14-year high. Excessive government spending combined with surging energy costs and rising inflation has caused many would-be homebuyers to lean toward the wait side of that argument. But is this really a bad time to purchase a new home? Maybe Continue Reading

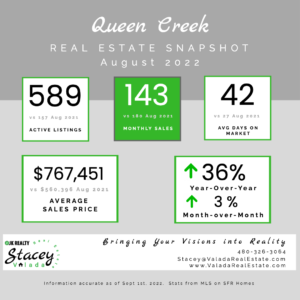

We Officially Hit a Balanced Market

Stats have finally caught up to the reality of the market. As of August we have officially reached a balanced market. The Cromford Index hit 106; a balanced market is 90-110, so we are now in the upper levels of balanced. This is similar to what we experienced in 2018 and 2019 before the craziness ensued. In August we also saw a stabilizing of the inventory. After a few months of sharp Continue Reading

Marry the Home, Date the Rate

Let's Talk Interest Rates! Interest rates have been the talk of the town. And it's no wonder with how quickly they have risen and the daily fluctuations which could be as high as 3/4 of a point in one day. Rates are currently hovering in the mid 5's. That sounds shockingly high! In reality, it's not. Take a look at the chart below (courtesy of Eric Swenson with Nova Continue Reading

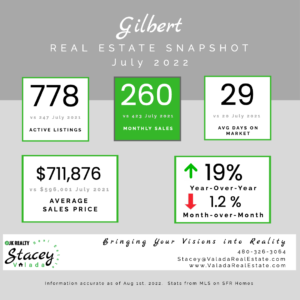

Balanced Market Here We Come

July Market Stat Highlights 🟢 Bidding wars have become a thing of the past 🟢 New inventory is up 7.7% month-over-month 🟢 Total Supply is up 237% year-over-year 🟢 3+ months of inventory in most SE Valley cities What does all this mean? Inventory is climbing and demand is dropping. The balanced market is right around the corner. Keep in mind stats are 30-45 days behind, so Continue Reading

- 1

- 2

- 3

- …

- 5

- Next Page »